More investors are turning to JP Morgan investment in 2025 as it enhances the self-directed investing experience for modern investors.

A Story Every New Investor Can Relate To

Meet Sarah – A Beginner Who Wanted to Invest but Felt Lost

Sarah is like millions of Americans in 2025—ambitious, financially aware, and eager to grow her savings. But when it came to investing, she hit a wall.

Everywhere she looked, there was jargon. Terms like ETFs, fractional shares, and Roth IRAs felt overwhelming. She had a stable job and a Chase bank account but didn’t know how to take the next step toward building wealth. She asked herself the same question that haunts many first-time investors: Where do I start?

That’s when she discovered JP Morgan Self-Directed Investing through her Chase app.

The experience was surprisingly simple. With $0 commissions, no account minimums, and the ability to buy fractional shares, Sarah realized she didn’t need thousands of dollars to begin. She could start with just $20 and still own a piece of top-performing companies.

What made it even better was JP Morgan Wealth Plan—a free financial coaching tool that helped her map out her goals. Whether she was planning for a future home, retirement, or just trying to make sense of her monthly spending, the Wealth Plan broke it all down into clear steps.

And suddenly, investing didn’t feel scary anymore.

Why Her Story Reflects Millions in 2025

In 2025, the face of investing is changing. More people—especially women, Gen Z, and first-time investors—are choosing platforms that are easy to use, affordable, and transparent.

Sarah’s story mirrors a broader trend: New investors want access, education, and trust. They’re looking for more than just a place to trade stocks—they want a partner who helps them grow.

JP Morgan Chase understands this. That’s why they’ve combined seamless banking and investing, launched tools like Wealth Plan, and built a library of over 1,500 articles to educate beginners.

For someone like Sarah—and anyone just starting their investment journey in 2025—JP Morgan Self-Directed Investing isn’t just a tool. It’s a launchpad.

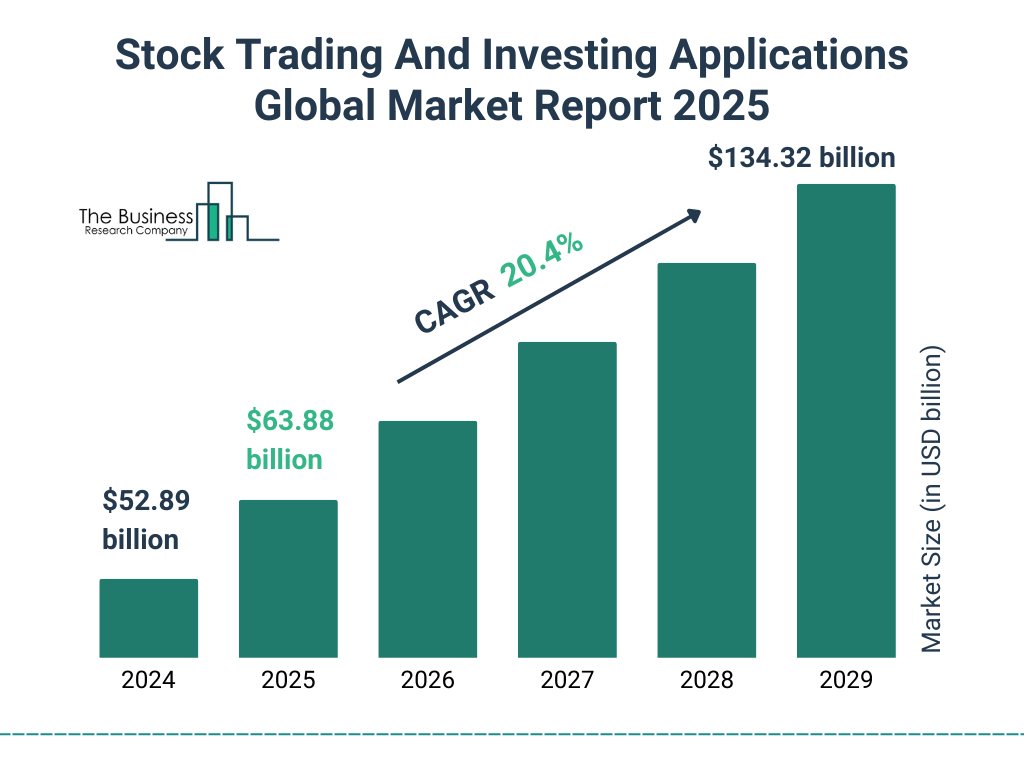

The 2025 Investment Boom and How JP Morgan Investment Fits In

In 2025, investing is no longer reserved for Wall Street insiders. With more tools, apps, and platforms available than ever before, everyday individuals are stepping into the investment world confidently. JP Morgan Investment is playing a key role in this transformation, offering beginners a smart, secure, and seamless entry point into modern investing.

Why More People Are Investing This Year

2025 has marked a significant shift in how Americans view money and investing. Economic uncertainty in previous years made people rethink traditional savings. Now, with digital access, better financial tools, and rising financial literacy, more individuals—especially younger generations—are taking their first steps into the world of investing.

One of the driving forces behind this investment boom is technology. Mobile apps, zero-commission platforms, and educational content have made investing more approachable than ever before. In fact, according to recent financial surveys, over 60% of new investors in 2025 say that they were motivated by ease of access and the potential to grow wealth outside of traditional savings accounts.

JP Morgan Investment is at the forefront of this shift. With its integration into the Chase banking experience, users can go from checking their bank balance to buying a stock—all in the same app. This convenience is making it easier for people to not just think about investing, but actually start doing it.

And it’s not just about convenience. In 2025, people are actively looking for platforms that are reputable, educational, and tailored for long-term growth—exactly what JP Morgan offers.

What Beginners Are Looking For

Today’s new investors aren’t looking for the fastest way to get rich. They’re looking for clarity, support, and low-risk options that help them build confidence.

Here’s what most beginner investors want in 2025:

- A simple, easy-to-use platform

- Low or zero fees

- Access to educational resources

- The ability to start with small amounts

- Brand trust and security

JP Morgan Self-Directed Investing checks all these boxes. It allows users to start investing with as little as $1 using fractional shares, offers zero commissions on U.S. stocks and ETFs, and gives access to learning tools right inside the Chase app.

Plus, beginners love that they can grow at their own pace—choosing between self-directed strategies or upgrading to advisory services when ready.

In the middle of the 2025 investing wave, JP Morgan Investment stands out not just for what it offers, but for how it supports every step of the beginner’s journey.

What Is JP Morgan Investment and How Does It Work?

For new investors in 2025, clarity matters more than complexity. JP Morgan Investment offers a modern, easy-to-understand platform that allows everyday people to grow their money without needing a background in finance. Whether you’re investing for the first time or want more control over your financial future, this platform is built to meet you where you are.

Simplifying the Platform for First-Time Investors

JP Morgan Investment—specifically its Self-Directed Investing product—is designed with beginners in mind. It’s a user-friendly investment platform accessible through the Chase Mobile® app or online banking, offering commission-free trading on U.S. stocks and ETFs.

What makes it ideal for first-timers?

- Straightforward design: The interface is clean, minimal, and doesn’t bombard users with confusing data.

- Fractional shares: You can invest in big-name companies like Apple or Amazon with as little as $1, making it easy to start small.

- Educational tools: Through JP Morgan’s “Learning and Insights” library, you get access to hundreds of beginner-friendly articles and videos.

- No minimum balance required: There’s no need to commit thousands of dollars upfront. You can start investing right away—on your terms.

It’s not just a trading platform; it’s a beginner’s gateway into long-term investing with the support of a trusted name in finance.

How It Fits Into the JP Morgan Chase Ecosystem

One of the most powerful features of JP Morgan Investment is how seamlessly it integrates into the broader JP Morgan Chase ecosystem.

If you’re already using a Chase bank account, you can track your banking, credit, and investments all in one place. This gives users a real-time overview of their financial life—something most competitors don’t offer in one single app.

Through the Chase app, users can:

- Instantly move money between checking and investment accounts

- Set long-term financial goals using the JP Morgan Wealth Plan

- Get insights into spending, saving, and investing habits in one dashboard

- Access both self-directed and managed investment options if they want to upgrade in the future

For anyone who wants to manage their money without juggling multiple platforms, JP Morgan Investment offers unmatched convenience, trust, and guidance—backed by one of the most well-known names in banking.

Why the JP Morgan Investment Brand Builds Trust

When you’re just starting out with investing, trust is everything. You want a platform that’s not only easy to use but backed by a legacy of financial expertise. JP Morgan Investment stands out in 2025 not just because of its tools, but because of the brand power and reliability that comes with it.

A Trusted Name for Over 200 Years

JP Morgan isn’t a startup trying to prove itself—it’s a global financial institution with over two centuries of history. Established in the early 1800s, the company has played a central role in shaping both the U.S. and global financial systems. From funding infrastructure and innovation to weathering major economic crises, JP Morgan has built a reputation on stability, resilience, and integrity.

In 2025, this history gives new investors confidence. When you invest with JP Morgan, you’re partnering with a brand that:

- Manages trillions in client assets

- Employs top-tier financial analysts and advisors

- Has decades of experience in navigating market ups and downs

This level of institutional knowledge and credibility is what gives JP Morgan Investment a strong foundation that newer platforms simply can’t match.

Why Beginners Rely on Industry Leaders

Let’s face it—if you’re just getting started, you want to avoid unnecessary risks. Beginners often choose industry leaders because they offer structure, safety, and a proven track record. That’s why JP Morgan Investment attracts so many new investors in 2025.

Here’s why beginners lean toward a well-established brand like JP Morgan:

- Security of your funds: Your assets are protected under SIPC insurance, and the platform follows strict regulatory standards.

- Reliable customer support: Need help? You’re backed by Chase’s robust service team—available online, in-app, or even in physical branches.

- Proven performance: JP Morgan’s in-house research and market insights help users make better decisions.

- All-in-one access: Banking, investing, saving, and financial planning—handled by one of the world’s most trusted institutions.

In a market full of choices, brand trust often becomes the deciding factor, especially for people who are just learning the ropes.

Final Thoughts – Why JP Morgan Investment Could Be Right for You

Stepping into the world of investing doesn’t have to be overwhelming. With a platform like JP Morgan Investment, you’re backed by over 200 years of experience, a simplified dashboard, and the trust of millions who are starting their financial journeys in 2025.

But this is just the beginning.

What’s Coming Next?

In the next part of this series, we’ll break down the real-world comparisons that matter most:

- Is JP Morgan Investment really better than Vanguard, Fidelity, or Schwab?

- What’s the truth behind zero-fee investing and how to avoid hidden costs?

- How can you choose between self-directed tools or expert guidance?

- And is it really possible to get started with just $5?

You’ll get answers, examples, and clarity—so you can invest with confidence.

We’ll cover this in our next article about JP Morgan vs. Fidelity, Vanguard & Schwab. Stay tuned!

You can also check this out: JPMorgan Chase Stock Rises 5% as Strong Interest Income Fuels Optimism Among Investors

One Response